How President Biden’s Agenda Slows Economic Growth

Diana Furchtgott-Roth | George Washington University

Table of Contents

II. Effects of Excessive Spending on Inflation

III. Increases in Taxes

VI. Conclusion

President Biden’s agenda includes raising taxes; substantially increasing government spending, including entitlement payments; imposing burdensome regulations on businesses and ordinary Americans; increasing the cost of labor through regulation and expansion of union power while real wages are declining; and forfeiting America’s energy independence.

Standing alone, each initiative is harmful to America’s economy. In combination, these initiatives have led to the increased possibility of an economic recession, as can be seen from the 1.4 percent decline in real Gross Domestic Product in the first quarter of 2022, the first decline in GDP since the pandemic.1 If this decline persists for another quarter, then the country will be in a recession. In addition to the decline in GDP, the results include rising inflation, currently at 8.3 percent, close to April’s 40-year high; supply chain problems; disincentives to work; and slower GDP growth.2 Inflation is an “invisible tax” and the effect on American families and small businesses is serious; higher gas prices; higher food prices; and labor shortages. If additional parts of President Biden’s agenda are enacted, we expect the elimination of millions of jobs, weakened national competitiveness, and increased dependence on other nations, including Russia and China, for our energy needs, further eroding our energy independence.

On his first day in office, President Biden rolled back many of President Trump’s pro-growth regulatory reforms and initiatives, reimposing costly regulations by Executive Order.3 Since then, President Biden and Congress have added trillions of dollars in government spending. Although the U.S. economy has continued to grow in large part from the 2017 tax cuts signed into law by President Trump, President Biden has repeatedly sought to raise taxes, most recently in a speech on the economy on May 10, 2022 and his proposed budget presented to Congress in March 2022.4 These proposed tax increases, if they were to become law, would cause corporations and small businesses to reduce investment. Some would move offshore. New taxes, regulations, and higher inflation are a signal to those interested in taking risks to start or to expand a business to wait on the sidelines until there is predictability and certainty in economic policies.

The paper describes how President Biden’s policies have weakened the American economy. We will examine increases in government spending, the effects of this spending on inflation, proposed tax increases, effects of labor regulations, and reductions in domestic energy production.

I. Federal Spending

In just over one year, President Biden has signed into law three major bills that expand Federal government spending by $4.4 trillion, or approximately 26 percent of a $24 trillion U.S. economy.5 This represents one of the largest, if not the largest, increase in government spending in history. Additionally, a fourth spending bill, Build Back Better, is still under consideration and would increase by tens of millions of people the number of Americans dependent on federal spending and subsidies. These proposed spending programs have no required evaluation to determine whether they help or hurt the individuals receiving the funds, or the economy.

The $1.9 trillion American Rescue Plan, which was signed into law in March 2021, provided a third round of Covid stimulus funds, following two rounds in 2020.6 The trillion-dollar Infrastructure and Jobs Act, signed into law in November 2021, increased traditional infrastructure spending in small part, but primarily expanded other spending that was unrelated to traditional hard infrastructure projects. The Omnibus Spending bill for fiscal year 2022, signed into law in March 2022, added another $1.5 trillion dollars in spending. Without regard to the harmful effects of this massive spending, President Biden has suggested yet another round of excessive spending with his proposed $5.8 trillion budget for fiscal year 2023.7

Congress spent $3.8 trillion in stimulus in 2020, an amount which was likely an overreaction to the uncertainty caused by the early days of the COVID-19 pandemic. Congress allocated an initial $233 billion of Federal spending for vaccines, testing, and paid sick leave in early March 2020. Later that month, the $2.2 trillion CARES Act became law and included $1,200 stimulus checks; expanded unemployment benefits; and hundreds of billions for corporations, small businesses, and state and local governments. The Paycheck Protection Act, a program of forgivable loans to keep workers employed, was expanded in April 2020, with another $483 billion. Finally, the $920 billion Consolidated Appropriations Act, signed into law in December 2020, provided another round of $600 stimulus checks, billions in funding for vaccines, additional unemployment benefits, and renewed financial assistance for small businesses.

In the third quarter of 2020, after an annualized decline of 31.2 percent in the second quarter from the preceding quarter, GDP rose by 33.8 percent at an annual rate, followed by an increase of 4.5 percent in the fourth quarter, and 6.3 percent in the first quarter of 2021.8 Demand rose, but expanded unemployment benefits and stimulus payments reduced work incentives, so the number of unfilled jobs mounted, and problems with supply chains increased.

The American Rescue Plan

Despite the strong growth in 2020, on March 11, 2021, President Biden signed into law the American Rescue Plan, with another $1.9 trillion in spending, at a cost of $6,000 for every American, or $24,000 for a family of four.

The American Rescue Plan had three major parts. First, it allocated $362 billion to state and local recovery funds. Many localities struggled to simply find ways to spend this unneeded money. Second, it provided $656 billion for direct financial assistance to individuals such as stimulus checks, unemployment benefits, and tax credits. The third part of the American Rescue Plan went to expanding a wide range of existing federal programs.

Infrastructure Investment and Jobs Act

The American Rescue Plan was not the only example of excessive spending signed into law by President Biden. Even though inflation was accelerating in the summer and fall of 2021–a situation that Federal Reserve Chairman Powell called “transitory”–President Biden called for additional spending in the form of a physical infrastructure bill and a social infrastructure bill, often termed respectively the Bipartisan Infrastructure Framework and the Build Back Better Act.

The $1 trillion Infrastructure Investment and Jobs Act was signed into law on November 15, 2021. The infrastructure law is another example of excessive spending and neglects post-pandemic changes in work, driving, and land use behaviors. Although Americans are driving more in a post-pandemic world, the new law allocates only $110 billion, about 10 percent of the total package, for building and repairing roads and bridges.

On the other hand, public transit, which relatively few Americans use, received $39 billion, in addition to the $70 billion that Congress allocated in 2020. To put this in perspective, the cost of running all 2,200 transit agencies in 2019 was $55 billion. Yet in 2021, President Biden requested another $109 billion for public transit, twice the amount that was needed to fund all public transit in 2019.

Furthermore, this excessive spending for public transit was signed as fewer people were actually using public transit, because they were working from home either full- or part-time. As more people worked at home during the pandemic and afterwards, the already failing transit model of transporting millions of people a day in buses and trains lost even more money than it did pre-pandemic.

Broadband received an additional $65 billion in federal funds in the infrastructure law, or $200 for every American. Yet Congress had no evidence in 2021 of how much additional funds, if any, were needed for broadband. In 2020, the Federal Communications Commission did a reverse auction for a Rural Digital Opportunity Fund to pay companies to provide broadband to places that did not already have it.9 The FCC allocated $9 billion to companies to provide the service to unserved areas.10 In addition, individual firms are investing tens of billions of dollars in broadband every year. Nowhere was there evidence that any new funds were needed, much less $65 billion.

Amtrak was allocated an additional $66 billion, even though few Americans ride Amtrak, following $3.7 billion in the three Covid-era stimulus bills and $2 billion in fiscal year 2020. But Amtrak’s ridership is lower than it was pre-pandemic, and will stay lower because communications is substituting for transportation. Billions of dollars are allocated to encourage electrification, despite Americans’ preference for vehicles with internal combustion engines.

The Infrastructure Investment and Jobs Act is exerting upward pressure on inflation. Prices of steel, lumber, and other construction materials are already high due to supply chain problems, and the new law will increase demand for these goods, resulting in even higher prices.

Build Back Better, President Biden’s social infrastructure bill, did not have the 50 votes to pass the Democrat-controlled Senate in 2021, but it may pass in 2022. If it passes, in whole or in part, the bill would increase entitlements, raise taxes and spending, and discourage more people from working, while making them dependent upon the government, making supply chain even problems worse.

Omnibus Spending Bill

The Omnibus Spending Bill, signed into law on March 15, 2022, added another $1.5 trillion in spending to fund fiscal year 2022 operations of the Federal government. Six percent higher than the FY2021 spending bill, it was passed almost six months into the start of the fiscal year.

Spending includes additional infrastructure funds, such as $8 billion for bridges, $5 billion more for Amtrak, and over $1 billion for electric vehicle charging stations. It also contains billions of dollars for affordable housing, education, childcare, healthcare, and research on climate change.

II. Effects of Excessive Spending on Inflation

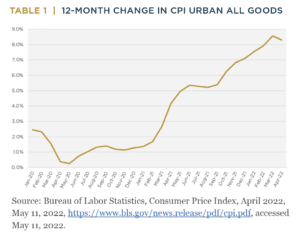

When President Biden took office in January 2021, the inflation rate was 1.4 percent, followed by 1.7 percent in February. By April, it reached 4.2 percent, and by the end of the year it was running at 7 percent. Inflation is now at an annualized rate of 8.3 percent, close to March’s rate of 8.5 percent, which was the highest level since 1981. It is acting as a hidden tax on Americans’ incomes, slowing real incomes and reducing the ability to buy goods and services.

The Labor Department reported that median weekly earnings for America’s 117 million full-time wage and salary workers rose by almost 5 percent over the past year. However, with inflation over 8 percent, American workers’ real incomes are declining by over 3 percent, rather than rising by 5 percent. Inflation is a hidden tax.

Expansion of entitlements led to supply chain problems and inflation as millions of Americans had not returned to work after the pandemic. The American Rescue Plan worsened this. By offering additional unemployment insurance and grants, it encouraged even more Americans to stay home rather than return to the labor force. People could only receive expanded unemployment insurance and Medicaid if they stayed home and if their incomes were below a certain level. Working meant that incomes for many Americans would have been too high to get the benefits, so they were economically incentivized to stay home.

Over the past year the cost of food has increased substantially. The cost of food eaten at home has risen 11 percent, but individual components have risen far more. Bakery products have risen by 10 percent, meat has risen by 14 percent. Some meat, such as uncooked beef and veal, is up by 19 percent, and bacon has risen by 18 percent.11 The cost of meals in restaurants went up by 7 percent.

The cost of materials and components for construction rose 23 percent, and the cost of construction rose by 14 percent.12 Softwood lumber rose 23 percent, and hardwood lumber was up 19 percent.13 When the government injects large sums of money into the economy and provides incentives for people not to work, inflation rises at historic rates. Providing a reasonable amount of federal funding for the development of COVID vaccines and testing could have been justified at the beginning of the pandemic, but the excessive spending in 2020, and in the 2021 American Rescue Plan Act, was as though Uncle Sam gave everyone coupons to eat at McDonalds but told employees not to show up for work. In such a case, it is easy to see that there would be lines and shortages at McDonalds. The same is true for the economy. By the end of 2021, households held record amounts in bank accounts, while labor force participation rates, at 62 percent, were well below the pre-pandemic levels of 63.3 percent, a loss of over 2 million workers.14

The Biden Administration claims that inflation is caused by the Ukraine war. But inflation and supply chain problems were harming American consumers well before the Ukraine war began on February 24, 2022, as can be seen from the inflation data. The inflation rate was 1.4 percent in January 2021 and 7.5 percent in January 2022.15 The Biden Administration harmed Americans with unwarranted spending, and then left consumers unprotected from the added harmful pressures from the Ukraine war.

By adding trillions of dollars in spending into a growing economy, the American Rescue Plan Act increased inflation. The Producer Price Index has risen by 11.2 percent over the past year.16 This signals that consumer prices will continue to increase in the months ahead, as producer price inflation works its way into consumer prices.

Extremely tight labor markets and the feedback of inflation on wages are keeping nominal wage increases elevated. In sum, President Biden’s inflationary policies are wiping out the wage-growth gains the American people experienced from 2017 through 2019.

The Federal Reserve has announced that it will increase the federal funds rate, the rate at which it charges banks to borrow, another six times in 2022 and several times in 2023.17 The Fed wants to move against inflation, but it does not want to risk slowing the economy in an election year. This puts the nominally nonpartisan organization in a difficult position. Inflation has never been reduced when the federal funds rate is lower than the inflation rate. With the federal funds rate at a quarter of a percent, and inflation at 8.3 percent, the Federal Reserve needs a series of federal funds rate increases to reduce inflation. It remains to be seen how effective the Federal Reserve will be.

No one knows definitively whether the Federal Reserve, through its rate increases, will drive America into a recession. But the facts show that when the Federal Reserve increased rates in 1974, 1980, 1981, 2000, and 2006, a recession followed.18 As the Federal Reserve raises the federal funds rate, borrowing becomes more expensive. Companies cut back on proposed projects because borrowing costs more than the potential rate of return. People find that their mortgage, credit card, and auto loan payments are higher, and they have less money to buy goods and to eat out. With purchases postponed and lower use of services, GDP growth is lower than would be the case otherwise.

III. Increases in Taxes

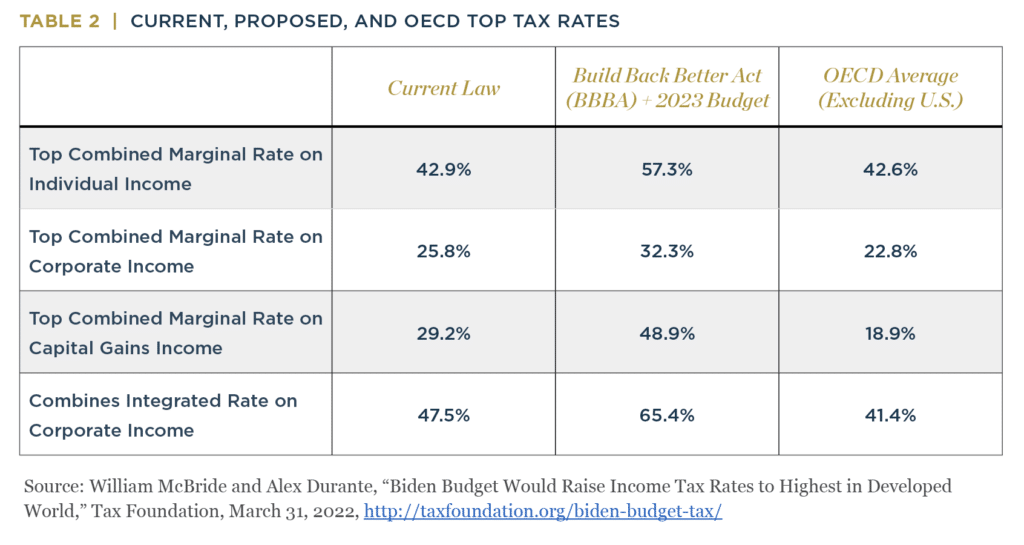

President Biden proposes to raise individual taxes, further reducing incentives for Americans to work and worsening the shortage of labor.19 In addition, he proposes to raise corporate taxes, reducing incentives for companies to invest in the United States.20 The Administration’s proposed increases in corporate tax rates above the global average would cause further investment to leave the United States, and result in more offshoring. The effect of these tax increases would shrink production and investment and reduce GDP growth.

On the individual side, President Biden has proposed the following harmful tax changes: raising the top tax rate from 37 percent to 39.6 percent; taxing unrealized capital gains at death; and raising the top tax rate on capital gains and dividends from 20 percent to 39.6 percent.21 In addition, in the fiscal year 2023 budget, President Biden has proposed a wealth tax for those with net wealth of over $100 million.22 These families would face taxes on the value of assets, such as stocks, bonds, or private companies, even before they are sold. President Biden’s proposal to tax wealth is an impractical idea that, if implemented, would result in fewer jobs, less investment, lower wages, and decreased productivity – creating an even worse environment for economic growth.

One reason wealth taxes are rarely used is that they are difficult to administer and have negative effects on the economy. The value of assets changes not daily, not hourly, but by the minute, and it is hard to determine the value of assets if they are not sold.

It is contrary to standard tax policy to tax a gain in assets but not to deliver a corresponding credit when the value of the assets declines, as would be the case in this proposed wealth tax. Most important, the imposition of such a tax would cause people to shift out of assets that would be taxed and into other assets such as art, instruments, jewelry, and cars—that are more difficult for tax collectors to find. This would harm the economy by removing a source of liquidity.

On the corporate side, President Biden proposes to raise taxes to 28 percent, up from the current rate of 21 percent. When average state and local taxes are added, the rate would be 32 percent, well above the 23 percent average of other developed countries.23

These tax increases, if implemented, would slow the economy and cause American firms to relocate to other countries with lower taxes. The Tax Foundation estimates that the corporate tax increase alone would shrink GDP by 0.7 percent and cost 145,000 jobs. The increases in capital gains taxes would shrink GDP by 0.3 percent and cost 27,000 jobs, according to the Foundation’s estimates.24

The total loss to the American economy from bad tax policy is not measured just in lower GDP growth and lost jobs. For the past few decades, many of the greatest inventions in history—from the Internet to wireless technologies to biotech to new medical services and new energy technologies—were developed in America during a period when we had competitive tax policies relative to other countries. If America adopts uncompetitive tax policies, not only will jobs go overseas, but so too will innovation and American entrepreneurship.

IV. Increases in Labor Costs

President Biden’s labor policies are raising the costs of labor, placing upward pressure on inflation. He is raising “prevailing” wages, the wages that firms have to pay workers for federally-funded projects.

On March 18, 2022, the Labor Department proposed changes in the Davis-Bacon Act.25 These changes would raise the “prevailing wages”—the higher wages to workers paid under government contracts—discarding reforms made in the Reagan Administration. Existing prevailing wages have been criticized for being higher than average wages paid for particular projects, and these new regulations, if passed, would raise wages further. Higher wages have the unintended consequence of keeping out low-skill workers, new entrants, and non-union firms from projects, because these workers do not make as much as unionized firms. Changes to the Davis-Bacon Act include the following.

- The proposed regulations would bring back a pre-Reagan era rule that allowed the prevailing wage to be based on wages paid to only 30 percent of workers in a particular trade.

- The Labor Department wants to have automatic increases in prevailing wages linked to the Department’s Employment Cost Index, irrespective of whether wages in a particular area went up as much as that Index.

- The regulations seek to merge urban and rural prevailing wages, instead of calculating them separately as was required by President Reagan’s regulations. Since wages in urban areas are higher, this results in higher prevailing wages in rural areas than were previously the case.

- The Labor Department wants to expand the definition of a work site to include work performed at a different site–on inputs to construction work, expanding the reach of the Act.

- Currently, the notice to pay Davis-Bacon wages must be in the contract. The new proposed rules want contractors to pay these higher wages without having them in the contract—and to withhold funds from contractors if these wages are not paid.

- Currently, new classes of prevailing wages for employees are based on Labor Department surveys. The new rules would allow the Department to set prevailing wages for new classifications of workers without using a survey.

On February 4, 2022, President Biden issued an Executive Order requiring Project Labor Agreements on construction projects worth $35 million or more. These agreements require union labor, which costs more than nonunion labor, even though only about 13 percent of the construction workforce is unionized, therefore leaving out 87 percent of construction workers. Project Labor Agreements for infrastructure construction cover not only construction workers, but also their subcontractors.26

The National Labor Relations Board General Counsel Jennifer Abruzzo is trying to make it easier for unions to organize workplaces by ordering employers to bargain with unions on the basis of signed authorization cards, rather than with a secret ballot election. In addition, in a violation of free speech laws, she is trying to remove the right of employers to hold team meetings in their workplaces to inform workers of the disadvantages of joining a union, such as the need to pay union dues, underfunded pension plans, and limited merit bonuses. Increasing the share of workers unionized would raise wages for employers, but these funds would not necessarily go to workers. Instead, they would result in a stream of dues to unions.

V. Increases in Energy Costs

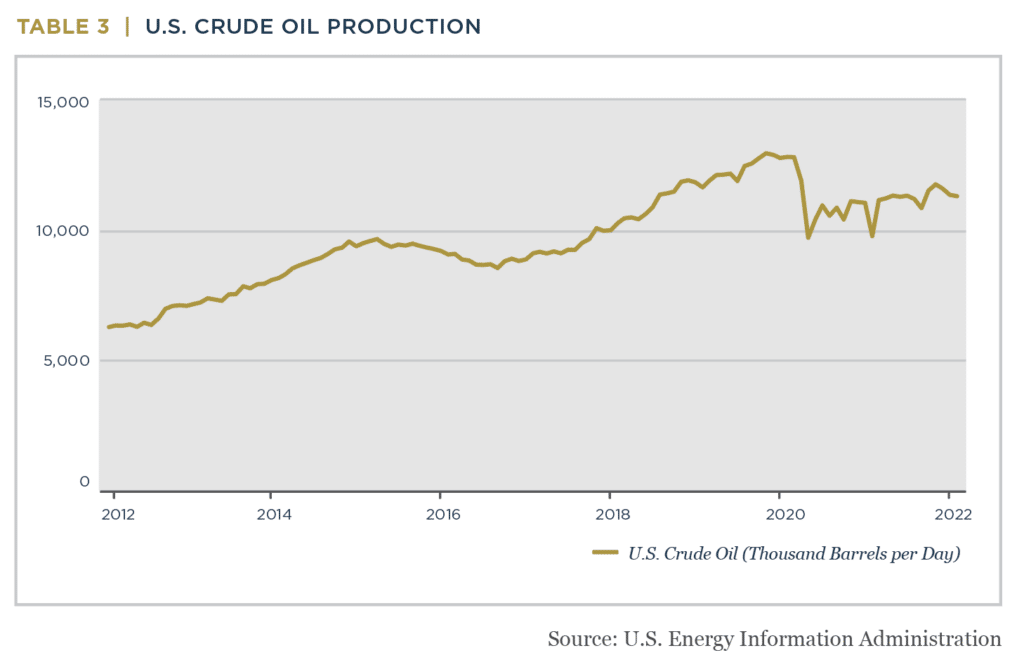

Even though energy production drove much of GDP growth over the past decade, President Biden has hindered oil and natural gas from being produced and refined in the United States, resulting in oil prices over $100 per barrel.27 He is limiting domestic oil production, pipeline construction, and approvals of terminals to export liquid natural gas, while at the same time calling on foreign rogue nations such as Venezuela and Iran to expand their production of fossil fuels. Fossil fuels produced abroad affect global emissions as much if not more than fossil fuels produced here at home.

The negative supply shock stemming from the rise in oil and commodity prices has raised inflation and will continue to exert upward pressure on inflation in coming months.28 Cutting back oil and gas production in the U.S., while encouraging other countries to expand production, shifts economic growth away from the United States and towards international rivals, reduces our GDP and our economic welfare, and contributes to a potential recession.

The latest set of inflation data show that energy costs have risen substantially over the past year. The price of gasoline rose by 44 percent between April 2021 and April 2022, and the price of fuel oil rose by 80 percent.29 These energy commodity costs have risen much faster than the average annual inflation rate of 8.3 percent.

These price increases are unnecessary, because North America has the world’s largest deposits of oil and natural gas. President Biden is asking Venezuela and Iran to produce more oil, when this could and should be done more easily here in the United States. Higher levels of energy production were common before President Biden took office.

Another of President Biden’s Executive Orders on his first day in office reduced domestic oil and gas production.30 The President expanded the boundaries of the Grand Staircase-Escalante, Bears Ears, Northeast Canyons, and Seamounts Marine National Monuments, which prevents oil exploration. In addition, he placed a moratorium on leasing activities in the Arctic National Wildlife Refuge and revoked the permit for the Keystone XL pipeline, which would have brought 850,000 barrels of oil per day from Canada to be refined in U.S. refineries.

In order to reduce oil prices, President Biden’s recent decision to ban imports of Russian oil products should have been accompanied by a decision to increase production at home, and to replace Russian crude oil with additional imports of Canadian crude. Using existing pipelines, Canada could supply the United States with an additional 250,000 to 400,000 barrels a day, which is refined by U.S. refineries, creating jobs and contributing to GDP growth.

The United States is a net exporter of oil, but imports heavy crude oil to refine and turn it into finished products, such as gasoline and heating oil. Russian crude oil accounted for only 3 percent of U.S. imports in 2021, and Canada accounted for 61 percent. If President Biden were serious about fighting inflation, then America needs to be increasing domestic production of oil and gas, and relying on our ally Canada, rather than Russia and Venezuela, for imported crude.

In 2008, America had net imports of around 11 million barrels per day.31 Now, America is a net exporter, selling around a million barrels per day. Associated natural gas production substituted for coal and reduced emissions, allowing the United States to achieve emissions targets without costly and intrusive regulation.

The Federal Energy Regulatory Commission issued a new policy on February 17, 2022, that will make it even harder to put new pipelines in place to carry oil and gas from the interior of the country to the coasts, where it can be exported.32 FERC will now “consider a proposed project’s impacts on existing pipelines” as well as the environmental effects of the new pipeline.

In November 2021, the Interior Department issued new recommendations that discourage drilling and call for fewer leases, higher royalties from oil and gas leases, and a more thorough bidding process to screen buyers.33 In addition, the Interior Department recommended that oil and gas drilling should not be prioritized. All these recommendations make it harder for our nation to develop enough energy sources to fuel our own economy and affect future energy price expectations.

Even the Securities and Exchange Commission wants to regulate energy production. On March 21, 2022, SEC Chairman Gary Gensler proposed rules to require companies to disclose information about governance and management of climate-related risks; how climate related risks will affect companies’ strategy and outlook; and the effects of climate events such as hurricanes and wildfires on financial statements.34 This will have the effect of further discouraging investments in fossil fuels, and allow the SEC to investigate companies that it believes are not correctly estimating climate effects.

By announcing a new policy focused on increasing rather than decreasing American energy production, President Biden could change expectations about the direction of U.S. energy production, resulting in an immediate decline in the price of oil and lower revenues to Russia. Instead, the Administration wants to continue to reduce domestic energy production, which helps Russia.

In addition, President Biden wants to do away with gasoline powered vehicles, a step which increases America’s dependence on China, the world’s largest producer of batteries for electric vehicles. President Biden has issued an executive order asking the auto industry to have the goal of half of new vehicles sold be electric by 2030, and all to be electric by 2035, following executive orders from Governor Gavin Newsom of California. This would significantly raise the price of cars, make Americans dependent on batteries from China, and require people to travel according to charging station locations. This dependence on foreign powers for an essential component of the U.S. economy—transportation by car and truck—could risk driving America even deeper into a recession if prices of batteries are outside U.S. control. The dependence of Europe on Russian gas has resulted in potentially recessionary increases in electricity prices over the past few months.

Russia’s invasion of Ukraine should have taught America that it’s not wise to sacrifice economic and national security by becoming dependent on a country that is not friendly to us. This means that the United States should not have its entire auto fleet dependent on batteries made in China.

VI. Conclusion

Prior to the COVID-19 pandemic, America had the strongest economy in the world, was energy independent, was the leading exporter of energy, and was poised for expansive future growth. President Biden dismantled pro-growth policies and his subsequent spending agenda is increasing the likelihood of a recession. With the Federal Reserve raising interest rates in an attempt to curtail inflation, real wages are declining, limiting Americans’ ability to purchase goods and services. These higher interest rates discourage investment in new projects and reduce expansion of existing enterprises.

Spending – Additional spending, including new spending on infrastructure, is not adding to productive growth. President Biden proposed, and Congress has passed, more than $4 trillion in new federal programs, likely the largest increase in government spending in history. The expanded spending programs, with vast increases in programs that required no more spending, are unnecessary and wasteful of taxpayer dollars.

Inflation – The clear evidence is that the Biden spending programs have harmed the economy. Inflation is close to 40-year highs as a result of Federal Reserve monetary accommodation combined with disincentives to work and produce. The American worker, our most important resource, is being discouraged from working to qualify for expanded entitlement programs. The Ukraine war is exacerbating inflation problems with the Biden Administration offering few meaningful responses. The Federal Reserve is combating inflation by raising interest rates and reducing its balance sheet, with no assistance from the Biden Administration, slowing economic growth in the process.

Taxes – President Biden proposes new taxes that will reduce American jobs, slow American growth, and diminish the prospects for innovation and entrepreneurship in America. That is a prescription for an uncompetitive economy, reducing economic growth and potentially leading America into a recession.

Labor – In addition, President Biden’s actions are resulting in higher labor costs than would be the case otherwise. He wants to raise the cost of labor by artificially raising wages by regulation, attempting to take away secret ballots for elections for union representation, requiring Project Labor Agreements, and making it harder to be an independent contractor. These actions raise the costs of employment, encouraging employers to reduce labor or move offshore.

Energy – America has been, and should still be, the largest producer of energy in the world. Yet, energy production and independence are not objectives of the Biden Administration. Ordinary Americans want more energy, not less. However, President Biden has adopted policies to ensure that America is neither energy independent nor generating more energy. Cutting energy production at home, while encouraging hostile countries to expand their production, further shifts U.S. economic growth overseas and contributes to slower growth. Mandating that all cars sold in America run on batteries will cause the United States to be dependent on China for vehicular transportation.

As inflation whittles away Americans’ real income, raising prices and decreasing the ability to buy goods and services, businesses will see a decline in sales, leading to lower earnings. This is how a recession starts. As seen by the recently released economic data, Biden’s policies have led to negative growth in the first quarter, and if this negative growth continues, the country will be in a recession. Has the Biden Administration put policies in place to lift sustainable growth? The answer is no.

Endnotes

- Bureau of Economic Analysis, “Gross Domestic Product, First Quarter 2022 (Advance Estimate),” April 28, 2022, https://www.bea.gov/sites/default/files/2022-04/gdp1q22_adv.pdf, accessed May 8, 2022.

- Bureau of Labor Statistics, Consumer Price Index, March 2022, Table 2, April 12, 2022, https://www.bls.gov/news.release/pdf/cpi.pdf, accessed April 24, 2022.

- Executive Office of the President, Executive Order 13992, January 20, 2021. http://www.federalregister.gov/documents/2021/01/25/2021-01767/revocation-of-certain-executive-orders-concerning-federal-regulation

- Office of Management & Budget, “Budget of the U.S. Government, Fiscal Year 2023,” March 23, 2022. http://www.whitehouse.gov/wp-content/uploads/2022/03/budget_fy2023.pdf, accessed April 25, 2022.

- American Rescue Plan Act of 2021 (H.R. 1319, P.L. 117-2), March 27, 2021. http://www.congress.gov/bill/117th-congress/house-bill/1319;

Infrastructure Investment and Jobs Act (H.R. 3684, P.L. 117-58), November 15, 2021. http://www.congress.gov/bill/117th-congress/house-bill/3684 ;Consolidated Appropriations Act of 2022 (H.R. 2471, P.L. 117-103), March 15, 2022. http://www.congress.gov/bill/117th-congress/house-bill/2471 - The three payments were included in the CARES Act of 2020 (H.R. 748, P.L. 116-136), the Consolidated Appropriations Act of 2021 (H.R. 133, P.L. 116-260), and American Rescue Plan Act of 2021 (H.R. 1319, P.L. 117-2).

- Office of Management and Budget, Budget of the U.S. Government, Fiscal Year 2023, https://www.govinfo.gov/content/pkg/BUDGET-2023-BUD/pdf/BUDGET-2023-BUD.pdf, accessed April 25, 2022.

- Bureau of Economic Analysis, Gross Domestic Product (Third Estimate), Corporate Profits, and GDP by Industry Fourth Quarter and Year 2021, Table 1, March 30, 2022, https://www.bea.gov/sites/default/files/2022-03/gdp4q21_3rd.pdf, accessed April 25, 2022.

- Federal Communications Commission, “Auction 904: Rural Digital Opportunity Fund,” http://www.fcc.gov/auction/904, accessed April 25, 2022.

- Federal Communications Commission, “Successful Rural Digital Opportunity Fund Action to Expand Broadband to Over 10 Million Rural Americans,” December 7, 2020, https://docs.fcc.gov/public/attachments/DOC-368588A1.pdf, accessed April 25, 2022.

- Bureau of Labor Statistics, Consumer Price Index, March 2022, Table 2, April 12, 2022, https://www.bls.gov/news.release/pdf/cpi.pdf, accessed April 24, 2022.

- Bureau of Labor Statistics, Producer Price Index, March 2022, Table 1, April 13, 2022, https://www.bls.gov/news.release/pdf/ppi.pdf, accessed April 24, 2022.

- Ibid, Table 2

- Bureau of Labor Statistics, The Employment Situation–April 2022, May 6, 2022, https://www.bls.gov/news.release/pdf/empsit.pdf, accessed May 6, 2022.

- Bureau of Labor Statistics, Consumer Price Index–March 2022, April 12, 2022, https://www.bls.gov/news.release/pdf/cpi.pdf.

- Bureau of Labor Statistics, “Producer Price Indexes, March 2022,” April 13, 2022. http://www.bls.gov/news.release/ppi.nr0.htm

- Federal Reserve Board of Governors, “Federal Reserve Board and Federal Open Market Committee release economic projections from the March 15-16 FOMC meeting,” March 16, 2022. http://www.federalreserve.gov/newsevents/pressreleases/monetary20220316b.htm

- Federal Reserve Bank of St. Louis, Federal Funds Effective Rate (series DFF), accessed April 14, 2022.

- Office of Management & Budget, “Budget of the U.S. Government, Fiscal Year 2023,” March 23, 2022. http://www.whitehouse.gov/wp-content/uploads/2022/03/budget_fy2023.pdf, accessed April 25, 2022.

- Ibid.

- Office of Management and Budget, Budget of the U.S. Government, Fiscal Year 2023, https://www.govinfo.gov/content/pkg/BUDGET-2023-BUD/pdf/BUDGET-2023-BUD.pdf, accessed April 25, 2022.

- Office of Management and Budget, Budget of the U.S. Government, Fiscal Year 2023, https://www.govinfo.gov/content/pkg/BUDGET-2023-BUD/pdf/BUDGET-2023-BUD.pdf, accessed April 25, 2022.

- Sean Bray, Corporate Tax Rates Around the World, Fiscal Fact No. 783, Tax Foundation, November 2021, https://files.taxfoundation.org/20211207171421/Corporate-Tax-Rates-around-the-World-2021.pdf, accessed April 24, 2022.

- William McBridge and Alex Durante, “Biden Budget Would Raise Income Tax Rates to Highest in Developed World,” March 31, 2022. The Tax Foundation. http://taxfoundation.org/biden-budget-tax/, accessed April 24, 2022.

- U.S. Department of Labor, “Updating the Davis-Bacon and Related Acts Regulations,” Federal Register, Volume 87, No 53, March 18, 2022. https://www.govinfo.gov/content/pkg/FR-2022-03-18/pdf/2022-05346.pdf, accessed April 25, 2022.

- Executive Office of the President, Executive Order 14063, February 4, 2022. Section 3 reads, “[A]gencies shall require every contractor or subcontractor engaged in construction on the project to agree, for that project, to negotiate or become a party to a project labor agreement with one or more appropriate labor organizations.” http://www.federalregister.gov/documents/2022/02/09/2022-02869/use-of-project-labor-agreements-for-federal-construction-projects, accessed April 25, 2022.

- Energy Information Administration, “Spot Prices for Petroleum and Other Liquids,” accessed April 14, 2022. https://www.eia.gov/dnav/pet/pet_pri_spt_s1_w.htm

- Bureau of Labor Statistics, “Consumer Price Index, March 2022,” op. cit.

- Ibid.

- Executive Office of the President, Executive Order 13990, January 20, 2021. http://www.federalregister.gov/documents/2021/01/25/2021-01765/protecting-public-health-and-the-environment-and-restoring-science-to-tackle-the-climate-crisis

- Footnote to Energy Information Administration, Department of Energy, but a different table

- Federal Energy Regulatory Commission, “Fact Sheet: Updated Pipeline Certificate Policy Statement,” February 17, 2022. http://www.ferc.gov/news-events/news/fact-sheet-updated-pipeline-certificate-policy-statement-pl18-1-000

- Department of the Interior, “Interior Department Report Finds Significant Shortcomings in Oil and Gas Leasing Programs, November 26, 2001. http://www.doi.gov/pressreleases/interior-department-report-finds-significant-shortcomings-oil-and-gas-leasing-programs

- U.S. Securities and Exchange Commission, Press Release, “SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors, March 21, 2022, https://www.sec.gov/news/press-release/2022-46, accessed April 25, 2022.