Reaganomics for the 21st Century

BY DANIEL J. MITCHELL

On behalf of the Club for Growth Foundation

Table of Contents

Overview

Government Spending

Tax Policy

Regulation

Monetary Policy

Trade Policy

Conclusion

Overview

Elected in 1980 and inaugurated in 1981, one of Ronald Reagan’s main goals was to restore America’s faltering economy. Inflation was the top concern for most citizens, but other serious problems included wasteful spending, high interest rates, punitive taxation, joblessness, and excessive red tape.

To deal with the plethora of challenges, Reagan had a four-pillar agenda:

- Limit government spending

- Lower marginal tax rates

- Reduce the burden of red tape

- Monetary restraint to lower inflation

President Reagan either achieved or made progress on each of these objectives, and his reforms were unambiguously successful. Real gross domestic product reached 7.2% in 1984 and averaged more than 4.5% during the final six years of his presidency.1

Importantly, this prosperity was widely shared. According to the Joint Economic Committee, “The Reagan expansion years marked a period of economic progress for middle class Americans. Middle class income increased 11 percent after adjustment for inflation, while nearly 20 million new jobs were created…. Meanwhile, the percentage of households with income over $50,000 jumped from 17.6 percent in 1980 and 1982, to 23.5 percent in 1989.”2 Additionally, President Reagan’s support of Federal Reserve Chairman Paul Volcker’s monetary policy reduced annual inflation from 13.5% in 1980 to 4.1% in 1988.3

Unfortunately, many of Reagan’s reforms have been eroded over the past 30-plus years, and the United States is once again facing major economic challenges. Is it time for Reaganomics 2.0? Some argue that America faces different problems that require different solutions. They assert that pushing for the same policies is “Zombie Reaganism.”

Many of those critics are avowed leftists, so their antipathy is not surprising.4 But there are also some self-described conservatives who use the same term to express hostility.5 This latter group sometimes makes unwarranted assumptions.

They assume support for Reagan-style small government conservatism:

- implies support for other policies adopted during the Reagan years, such as immigration amnesty.

- comes at the expense of conservative social policy.

- means no concern for the value of a defense industrial base.

- means being in favor of a “neoconservative” nation-building agenda.

- is somehow inconsistent with communitarian values.

This paper does not address those issues, other than to state that the desirability of Reagan’s four-pillar agenda does not depend on those other topics. To assess the merits of modern-day small-government conservatism, this paper will briefly explain the problems Reagan faced and the solutions he pursued, followed by an examination of today’s problems and the degree to which similar policies could and should apply.

In short, America faces remarkably similar challenges to those that confronted President Reagan. The combination of reckless government spending6and money printing7 have fueled the worst inflation in 40 years and forced the Federal Reserve to substantially raise interest rates.8 American tax rates remain elevated when compared with OECD averages, putting the U.S. at a significant disadvantage for attracting capital investment.9 Finally, regulatory costs have steadily climbed since the Reagan years.10 The Biden administration has embarked on a dangerous campaign to supercharge this regulatory expansion – the cost of which will be borne by hardworking American taxpayers through reduced economic growth.11 12 Policymakers who wish to boost middle-class incomes would be wise to emulate President Reagan.

Government Spending

Regardless of how it is financed, government spending diverts resources from the productive sector of the economy. To minimize the economic damage, lawmakers in Washington should strive to limit the size and scope of the federal government. Ideally, certain departments and agencies should be abolished.

Spending discipline is not popular among politicians, but there is remarkable consensus among public finance experts that restraint is the right policy to boost prosperity while bigger government has very adverse effects on growth.

- Research from the Congressional Budget Office in 2021 determined that tax-financed spending is bad: “The largest declines in economic activity among the financing methods considered occur with the progressive tax on all income. Those declines occur because high-productivity workers reduce their hours worked and because higher taxes on asset income reduce the incentive to save and invest relatively more than under the two flat taxes.”13

- And a separate study from CBO in 2022 found similar results: “the higher tax rates that would be required… would reduce after-tax wages, which would discourage work and lower the aggregate supply of labor. Those reductions in capital stock and the labor supply would cause GDP to be lower… As a result, GDP would be 0.9 percent lower in 2051 if implementation of the policy was delayed by 5 years and 2.6 percent lower if it was delayed by 10 years.”14

- A study from the Organization for Economic Cooperation and Development found that, “a reduction in the size of the government could increase long-term GDP by about 10%”15

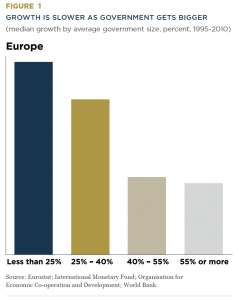

- A report from the World Bank concluded that, “a 10-percentage point increase in initial government spending as a share of GDP in Europe is associated with a reduction in annual real per capita GDP growth of around 0.6–0.9 percentage points a year.”16

Here’s a very instructive chart from the World Bank study. Unfortunately, the overall burden of government spending in the United States is now approaching 40 percent of economic output. So, it should be no surprise that growth has been sluggish.

A core insight from all the research is that government cannot spend money without first diverting the money from the productive sector of the economy. Politicians like Joe Biden often call attention to interest groups getting showered with federal largesse, wanting people to think that there is new money or new wealth in the economy. But that is not true, the government either taxed the money out of the private sector, borrowed the money from the private sector, or financed the spending by printing money (arguably the worst option).

The problem in 1980:

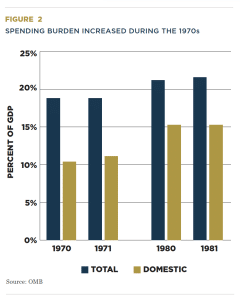

As a candidate, Ronald Reagan told voters that the federal government was too big and spending too much. He was right. The following chart comes from the Historical Tables of the Budget, maintained by the Office of Management and Budget.17

Here’s the data from Table 8-4 (“Outlays by Budget Enforcement Act Category as Percentages of GDP”), which shows that the total burden of federal spending increased from less than 19 percent of economic output at the start of the decade to more than 21 percent of economic output by the end of the decade.18

Even more worrisome, domestic spending (almost everything other than defense spending and net interest outlays) was becoming an ever-larger burden on the economy. At the start of the decade, domestic spending consumed about 11 percent of GDP. By the end of the decade, more than 15 percent of the economy’s output was being diverted to finance those outlays.

To make matters worse, the Congressional Budget Office projected that the burden of spending would continue to increase. In testimony just seven days after Reagan’s inauguration, the CBO’s Director warned that “Total outlays would grow by another 12 percent in 1982 under President Carter’s spending proposals.” All told, the Director estimated that “Outlays as a percentage of GNP are projected at 23 percent for 1982 in the Carter budget.”

Reagan’s solution:

During the campaign, Reagan urged spending restraint and explained that America would be stronger if the size and scope of the federal budget was constrained. He was especially concerned about reducing the burden of domestic spending.

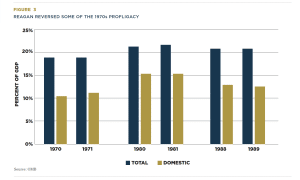

The good news is that the CBO projections of further expansions in the burden of federal spending did not materialize. The better news is that Reagan actually presided over a reduction in the overall burden of spending, which fell from 21.6 percent of GDP in Carter’s last budget to 20.6 percent of GDP in Reagan’s final budget. And the best news, as shown in the chart, is that Reagan managed to put the brakes on domestic spending, with outlays for those programs dropping from 15.3 percent of GDP in Carter’s final budget to 12.8 percent of GDP in Reagan’s last budget.

But there is bad news. Notwithstanding all of Reagan’s progress, he was not able to fully undo the fiscal damage of the 1970s. The burden of overall federal spending was higher when Reagan left office than it was at the start of the 1970s. And the burden of domestic spending also was higher in the late 1980s than it was in the early 1970s.

The problem today:

Unfortunately, America’s spending problem today is worse than it was when Reagan was elected and inaugurated. The overall burden of spending has reached more than 24 percent of economic output and domestic spending by itself consumes more than 19 percent of GDP.

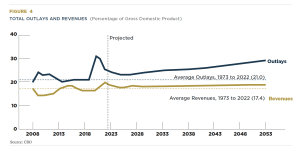

That is bad news, but the future news is even worse. According to the Congressional Budget Office’s 10-year forecast, government will consume an ever-larger share of the economy’s output – 25 percent of GDP – by 2033.19

And the CBO 30-year forecast is even more depressing.20

As shown in Figure 2-1 of the report (see Figure 4 above), more than 29 percent of the nation’s GDP will be diverted to federal spending (the first spike was for the TARP bailout and Obama’s so-called stimulus, and the second spike was for the trillions of dollars of pandemic spending).

All this spending – both past and present – undermines growth by diverting resources from the productive sector of the economy. Unfortunately, some politicians are short-sighted. They see things funded by taxpayers and believe they are creating new output. But they fail to realize that the private sector would have allocated the money far more efficiently.

The higher burden of spending over the next three decades is driven entirely by higher spending on entitlements and increased interest payments on the national debt.

Reaganomics 2.0 solutions:

Since the problem is that spending is growing too fast, the obvious solution is to cut spending. Or, more realistically, to at least limit the growth of spending so that it grows slower than the private sector. There are several types of policies that can help achieve this goal:

- Eliminate or reduce counterproductive programs, agencies, and departments.

- Reform entitlement programs so they are fiscally sustainable.

- Reinvigorate federalism by shifting certain activities back to state and local governments.

There are three major types of spending in the federal budget. Understanding these categories will help guide our discussion:

- Discretionary programs are financed every year through the appropriations process, and budget analysts generally divide these outlays between domestic discretionary and defense discretionary.

- Entitlement programs operate on autopilot, with spending determined by eligibility rules. Budget analysts generally divide these outlays between means-tested entitlements for poor people and age-determined entitlements for old people.

- Net interest is the amount of money that is needed to pay the bondholders who have lent money to the federal government.

Domestic discretionary spending is a very ripe target for budget savings. Spending on these programs, adjusted for inflation, has doubled since the 1980s. And this spending finances many of Washington’s most wasteful programs and counterproductive departments.

Entitlements are the major budget challenge. More than 70 percent of the federal budget is allocated to these programs, and that share will increase since entitlement spending is projected to become an even bigger burden in the future. Dealing with the means-tested programs is relatively simple since lawmakers could copy the very successful welfare reform from the 1990s, which involved decentralization and block grants. Work requirements are another very attractive option since they would help build a culture of individual responsibility.

Dealing with age-related entitlements is a larger challenge, particularly health programs such as Medicare. Medicare should be modernized for multiple reasons. Not just to save money for taxpayers, but also to ensure the programs is sustainable for current and future senior citizens. A better system, perhaps copying the choice model available to federal government employees, would help improve efficiency and control prices in the health sector. And it also is imperative to control the fraud which is rampant in the program.

Social Security spending is not growing nearly as fast as outlays for the health entitlements. Nonetheless, the United States should copy nations such as Australia, Sweden, Chile, Denmark, Singapore, and Switzerland by giving workers – especially younger workers – the freedom to choose personal retirement accounts.

To help achieve these policies, some sort of spending restraint would be desirable. One option is a tax limitation/balanced budget amendment, which would force politicians to balance the budget unless they could get supermajority support for additional debt-financed spending or supermajority support for additional tax-financed spending. The inclusion of a taxlimitation provision is critical since otherwise politicians might use a balanced-budget requirement as an excuse to raise taxes – something that unfortunately happens in some states.

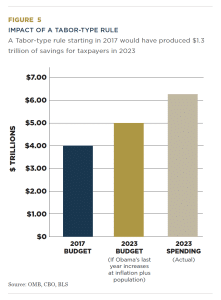

Another option is a spending cap. The best model in the United States is Colorado’s Taxpayer Bill of Rights. The TABOR provision in Colorado’s constitution effectively limits spending so that it cannot grow faster than the combination of inflation plus population. To get a sense of how this approach would be very effective, here’s a chart showing what this year’s budget would be if Obama’s final budget (FY2017) was increased by inflation plus population. The savings would be $1.3 trillion, and the deficit would be less than $300 billion rather than more than $1.3 trillion.

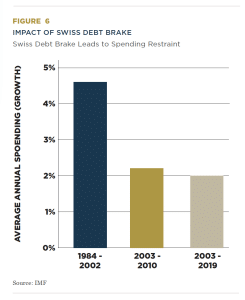

Globally, the best model is Switzerland’s spending cap. Known as the Debt Brake, the Swiss policy has been dramatically successful in slowing the growth of federal spending. It was overwhelmingly adopted by voters in a 2001 referendum and took effect starting in 2003. As shown by the chart, spending has since grown at a much slower rate, both in the short run (2003-2010) and long run (2003-2019). As a result of this spending restraint, Switzerland’s government debt has been declining, both in absolute terms and as a share of GDP.

Since the Swiss spending cap has an emergency opt-out provision, outlays did increase faster during the COVID pandemic. But the second chart shows that debt increased at a much slower rate in Switzerland than in the United States. Moreover, Swiss policy makers are obliged to compensate for the temporary spending increases by imposing additional spending restraint in future years. Constitutional reform, such as TABOR or the Swiss spending cap, is the ideal long-run reform. But such reforms are the means to an end.

The ultimate goal is to slow the growth of federal spending. Failure to control spending will weaken the economy’s performance as more resources are diverted from the productive sector of the economy. And that damage will occur regardless of whether the spending increases are financed by taxes, borrowing, or printing money.

Tax Policy

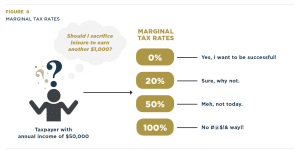

Governments impose “sin taxes” because they want to discourage behaviors such as drinking and smoking. Regardless of whether one thinks that is a proper role of government, the economic analysis is correct: the more you tax of something, the less you get of it. However, that essential insight also applies to taxes on work, saving, investment, and entrepreneurship. Which is why good tax policy should seek the lowest-possible tax rates on productive behavior:

- Low tax rates on work lead to more entrepreneurship, which improves competitiveness and encourages job creation.

- Low tax rates on saving and investment lead to more capital formation, which is the key to raising productivity and higher wages.

Lawmakers should be guided by a desire to collect revenue in a way that minimizes the damage to prosperity. Entrepreneurship and investment are vital and necessary for rising living standards. Simply stated, incentives matter.

The problem in 1980:

The United States had punitive tax rates when Reagan was elected and inaugurated. The top personal income tax rate was confiscatory, taking 70 percent of taxable income above $108,300 for single workers and $215,400 for married households. State income taxes made the system even more onerous. Corporate tax rates also were too high. The federal rate was 46 percent, and the average of state corporate taxes pushed the effective rate even higher. Further, because of double taxation on interest, dividends, and capital gains, high tax rates on personal and corporate income exacerbated the tax code’s bias against saving and investment.

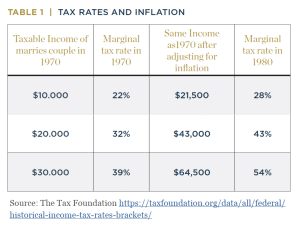

But the main problem is that there were huge indirect and unlegislated tax increases leading up to 1980. To be more specific, inflation was a major problem at the time, with prices rising by about 115 percent during the 1970s.21

And when households received more income to help them keep pace with inflation, that put them into higher tax brackets.22

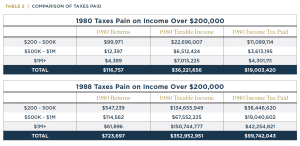

As a result, government collected more money even as many people were falling behind. The chart shows the impact of bracket creep on three hypothetical households earning what would have been decent-to-good middleclass incomes back in that era.

Reagan’s Solution:

In 1981, Reagan convinced Congress to enact the Economic Recovery Tax Act, which phased in lower income tax rates for all taxpayers. The top rate was dropped to 50 percent and other rates were proportionately lowered. Equally important, Reagan got Congress to adopt “indexing,” which meant that tax brackets were automatically adjusted for inflation. That reform ensured that government no longer profited from inflation.

During his second term, Reagan then worked with Congress to approve the Tax Reform Act of 1986. That legislation further lowered tax rates for all taxpayers, with the top marginal tax rate falling to 28 percent. The legislation also reduced the corporate tax rate to 34 percent.

While Reagan’s tax cuts reduced revenue (especially compared to what would have happened with continuing bracket creep), there was nonetheless substantial revenue feedback. This simply means that better tax policy led to more taxable income. The additional tax on that additional income partially offset the impact of lower tax rates. In the case of upper-income taxpayers, data from the IRS Statistics of Income indicates that lower tax rates resulted in more revenue.23

More important, the Reagan tax cuts helped trigger an economic boom. The United States experienced a record economic expansion, with millions of jobs being created and family incomes rising to record levels after the malaise and stagnation of the Carter years. Households earned more money, and they got to keep a greater share of their earnings. Net worth also increased substantially, putting America’s middle class in a very strong position.

The problem today:

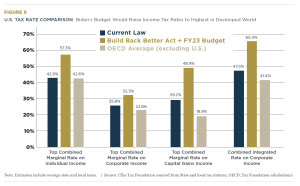

The bad news is that tax rates have increased since Reagan left office. The good news is that rates are still lower than they were when Reagan entered office. But this is hardly a cause for celebration. Not only have other nations been lowering tax rates in recent years, but the United States has a problem with “double taxation” that is significantly worse than in most other developed nations. More specifically, America suffers from very high effective tax rates on dividends and capital gains.

The chart on the following page (Figure 9) from the Tax Foundation compares current U.S. tax policy with the average of other rich nations. In every case, the American tax system has higher rates. And the U.S. disadvantage is especially severe when looking at the taxation of dividends and capital gains. The chart also shows that President Biden’s tax proposals would have significantly undermined American competitiveness by radically increasing tax rates.

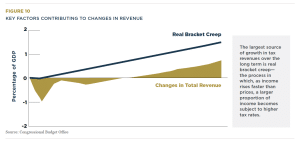

The United States also has a problem with “real bracket creep,” which occurs when people wind up in higher tax brackets because their inflation-adjusted income goes up. Practically speaking, this means that the federal government’s tax burden automatically increases whenever there is real economic growth. The following chart (Figure 10) from the Congressional Budget Office shows how this will mean a higher aggregate tax burden over time.

Reaganomics 2.0 solutions:

To boost American competitiveness and protect Americans from higher taxes, lawmakers should lower tax rates and reduce double taxation. The current system has tax rates ranging from 10 percent to 37 percent. The ideal solution is a low-rate flat tax that sweeps away the 75,000-plus pages of the internal revenue code. But interim reforms also can be very desirable. The 2017 tax legislation, for instance, lowered tax rates on households and business, and those pro-growth reforms were partly financed by curtailing the deduction for state and local taxes (which subsidized the punitive policies of high-tax states such as California and New York).

Doing something similar to the 2017 tax reform could bring the country back to the kind of tax rates that existed after Reagan’s 1986 Tax Reform Act:

- 28% for single taxpayers with incomes over $539,900 ($647,850 for married couples filing jointly);

- 26%, for incomes over $215,950 ($431,900 for married couples filing jointly);

- 24% for incomes over $170,050 ($340,100 for married couples filing jointly);

- 20% for incomes over $89,075 ($178,150 for married couples filing jointly);

- 18% for incomes over $41,775 ($83,550 for married couples filing jointly);

- 10% for incomes over $10,275 ($20,550 for married couples filing jointly).

Regarding the tax code’s bias against saving and investment, the flat tax remains the ideal solution. That simple and fair system would abolish all forms of double taxation, such as the double tax on dividends, the capital gains tax, and the death tax. But the perfect should not be the enemy of the good. Reducing the capital gains tax rate from 23.8 percent to 10 percent, for instance, would be a very desirable reform. Needless to say, the death tax should be fully abolished, for both moral and economic reasons.

Regulation

Red tape refers to a wide range of rules imposed by various government agencies. Regulations increase the cost of economic activity, sort of the way it is more difficult to get from Point A to Point B on an obstacle course. Red tape theoretically can be justified if benefits exceed costs but that rarely happens.

The problem in 1980:

Measuring regulatory burdens is not easy. There are myriad types of red tape that govern and restrict economic behavior, and there is no consensus on the best way to compare different types of regulation. There also is not a consensus on how to measure potential benefits of different rules and mandates.

Given these difficulties, experts often use the number of pages in the Federal Register as a proxy to show the extent to which the regulatory burden is increasing (federal bureaucracies are required to use the Register to notify the public about proposed changes in red tape). But this is an imperfect measure since some proposed regulations may not require many words but can still be very expensive. Moreover, bureaucracies that want to deregulate also have to publish changes in the Register, so some of the pages may represent proposals to reduce the burden of red tape.

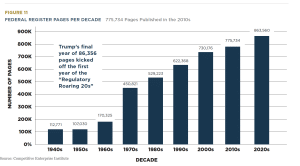

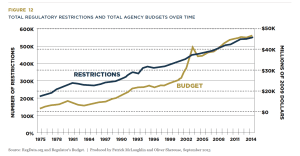

With all these caveats in mind, Figure 11 on the following page depicts how regulatory activity dramatically increased in the 1970s.

Reagan’s solution:

Figure 11 above shows a dramatic slowdown in the number of pages added to the Federal Register in the 1980s. At the very least, that suggests Reagan stopped an onslaught of red tape. Reagan had many deregulatory initiatives, such as getting rid of price controls on energy. Implementing those successful policies required notices in the Register.

The chart below (Figure 12) from the Mercatus Center captures the broader impact of Reagan’s presidency. You can see that both regulatory budgets and regulatory restrictions were rising before Reagan took office, were basically flat when he was in office, and then resumed rising after he left office (see Figure 12 below).

Incidentally, it should be noted that Reagan’s predecessor got the ball rolling on deregulation. Airlines, trucking, and rail were partially or fully deregulated during the Carter Administration.24

Those policies were very successful in lowering prices and increasing efficiency in the respective industries. Reagan’s appointees helped implement those good reforms.

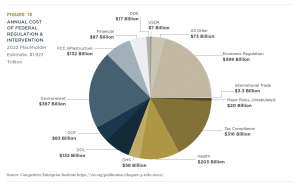

The problem today:

The two previous charts show that there has been a regulatory tsunami since Reagan left office. There are now almost twice as many pages in the federal register as there were in the late 1980s. Meanwhile, regulatory budgets have tripled and regulatory restrictions have doubled since the end of the Reagan years.

Reaganomics 2.0 solutions:

When in a hole, the first part of the solution is to stop digging deeper. As shown by the REINS Act,25 there are many ways to reverse the current trajectory of ever-increasing red tape. Here are some specific proposals that would help limit red tape:

- Require the elimination of a certain number of existing regulations before a bureaucracy can impose a new regulation.

- Insist that all regulations pass a cost-benefit test overseen by independent economists at the Office of Information and Regulatory Affairs.

Enact a regulatory budget to limit the overall cost of red tape. - Implement a competitiveness requirement so that regulation is never stricter than our foreign competitors with regards to so-called agreements like the Paris Climate Accord.

- Require stand-alone approval by both the House and Senate before any major regulation (costing $100 million and above) can be finalized.

- Adopt “mutual recognition” agreements with advanced allied nations so that Americans can access everything from baby formula to prescription drugs without waiting for bureaucratic approval in the U.S.

- Create a Regulatory Bill of Rights to give anyone investigated by a regulatory agency the same legal rights as accused criminals, as well as the right to recover damages if bureaucrats engage in abusive behavior.26

The bottom line is that red tape imposes a very costly burden on the United States that stifles entrepreneurship and innovation. Our competitiveness suffers and living standards are lower than they should be.

Monetary Policy

In an ideal world, central banks such as the Federal Reserve in Washington play a very quiet role, ensuring enough liquidity for long-term price stability and a smoothly functioning economy. Unfortunately, central bankers often feel compelled or pressured to create too much money. This is because incumbent politicians benefit when there is an illusion of more short-run prosperity.

The problem in 1980:

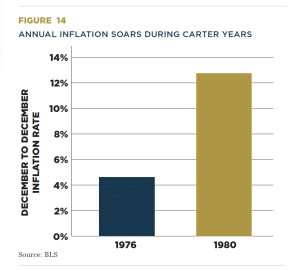

The United States was plagued by double-digit inflation when Reagan was elected. Rising prices were a problem throughout the 1970s, and the problem became particularly acute during the Carter Administration (see Figure 14), with prices climbing by nearly 50 percent in just four years.27

As illustrated by the chart, annual inflation jumped from less than 5 percent to more than 12 percent.

The Federal Reserve deserved the blame for the surge in prices. The central bank created too much liquidity, motivated in part by a belief in Keynesian monetary policy and in part by a desire to appease politicians who like the sugar high of easy money.

To make a bad situation worse, prices were increasing faster than income, which meant that the average household was falling behind. According to the Census Bureau, when Reagan took office in 1981, both median and mean household income was several hundred dollars lower than when Carter took office in 1977.28

Reagan’s solution:

Unlike other presidents, who favored the sugar high of easy money, Reagan understood that the Federal Reserve needed a restrictive policy to bring inflation under control. He supported Chair Paul Volcker’s efforts to slow monetary growth even when it became politically unpopular. He courageously did what was best for the nation, even though it hurt his party in the 1982 mid-term elections. Here is a summary of what happened from Robert Samuelson, a columnist for the Washington Post:

What Reagan provided was political protection. The Fed’s previous failures to stifle inflation reflected its unwillingness to maintain tight-money policies long enough… Successive presidents preferred a different approach: the wage-price policies built on the pleasing (but unrealistic) premise that these could quell inflation without jeopardizing full employment. Reagan rejected this futile path. As the gruesome social costs of Volcker’s policies mounted — the monthly unemployment rate would ultimately rise to a post-World War II high of 10.8 percent — Reagan’s approval ratings plunged. …Still, he supported the Fed. …It’s doubtful that any other plausible presidential candidate, Republican or Democrat, would have been so forbearing.29

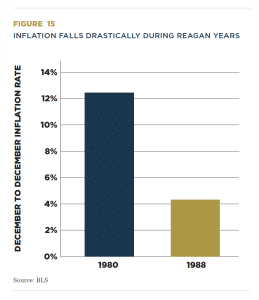

Reagan’s courage paid dividends. The inflation rate came down very quickly. As shown Figure 15 below, inflation was down to about 4 percent in 1988:

The problem today:

Sadly, history is repeating itself. Inflation jumped dramatically in 2022. Once again, the Federal Reserve deserves the blame. The Fed dramatically increased liquidity when the pandemic began in early 2020. The initial decision to create more money was probably justified given the widespread fears of an economic meltdown. But then, the Fed kept pumping more liquidity into the economy (by expanding its balance sheet), continuing with its easy-money policy for the rest of 2020, all of 2021, and the first half of 2022.

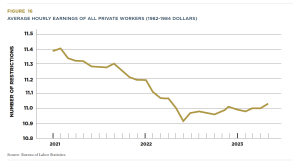

Moreover, this inflation is having the same negative effect as the Carter-era inflation. Figure 16 below is a chart from the Wall Street Journal, showing that inflation-adjusted wages are considerably below where they were when Joe Biden took office:

The Fed’s easy-money policies also hurt savers by driving down yields, making life more difficult for those trying to prepare for retirement.

Reaganomics 2.0 solutions:

The Federal Reserve needs to follow a tight money policy by shrinking its balance sheet. In other words, instead of buying government bonds (the process of creating money), it should sell bonds and sop up more of the excess liquidity in the economy. The Fed belatedly has started to do this but remains to be seen whether the current White House will display the same fortitude as Reagan.

Bringing inflation under control is the obvious short-run goal, but the bigger issue is how to stop bad monetary policy in the future. The Fed has an unfortunate tendency to produce boom-bust cycles and bad monetary policy bears much of the blame for every economic downturn in the past 100 years. There are several possible fixes:

- First, lawmakers could repeal the “dual mandate” of price stability and low unemployment. The Fed has direct ability to avoid inflation because of its control over monetary policy. It does not, however, have power over taxes, spending, regulation, trade, and other policies that affect employment.

- Second, lawmakers could impose some sort of rule on the Fed governing how fast it can expand the money supply. For example, money growth could be restricted to a fixed percentage each year (as proposed by Milton Friedman) to prevent rapid increases in the money supply that supercharge inflation. An inflation target could be another way of tying the Fed’s hands.

- Third, lawmakers could take an additional step and copy New Zealand, contractually obliging the central bank to keep inflation within a certain level. Failure to comply would allow central bank officials to be dismissed. This increases the accountability of the Federal Reserve for its monetary policy decisions.

- Fourth, lawmakers could remove barriers to private and/or competing currencies, giving people some ability to protect themselves from monetary mistakes by government.

The bottom line is that politicians and central bankers have too much discretionary power. To protect the American people from inflation and monetary instability, the Federal Reserve needs to be handcuffed.

Inflation is not the only issue that merits attention. There are very serious concerns that central bankers are sympathetic to the notion of eliminating cash and imposing a central bank digital currency.30

This is a very dangerous concept that would give politicians immense power to confiscate and/or control how and when the American people could spend or save their money.

Last but not least, the Federal Reserve should not be immune from oversight. The American people have a right to know what the Fed is doing and how much money it is spending.31

Trade Policy

Reagan’s four-pillar agenda did not include trade, but let’s expand this paper with a brief mention of his views and accomplishments with regard to cross-border commerce. Reagan repeatedly used the bully pulpit to defend free trade.32 He understood that trade was good for consumers, good for farmers, and good for manufacturers. Protectionism, by contrast, was a corrupt process that made the economy less efficient and less dynamic.

The problem in 1980:

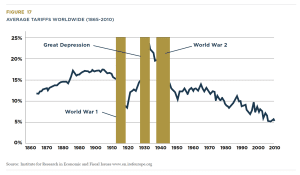

Having learned bitter lessons from the Smoot-Hawley legislation that dramatically increased taxes on trade (and contributed to the Great Depression), lawmakers around the world dramatically lowered tariffs and other trade barriers immediately after World War II. This was followed by several decades of relative stability. But, as shown in Figure 17 on the following page, this chart from a French think tank, trade taxes began to increase as the 1970s came to a close.33

The changes were not dramatic, especially when compared to the rampant protectionism of the 1930s and the postwar liberalization. However, there were still needless restrictions on cross-border trade. Tariff rates were too high and various non-tariff barriers added sand to the gears of the global economy.

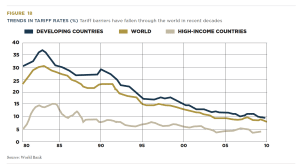

Reagan’s solution:

While he did impose a few trade restrictions for political reasons, President Reagan aggressively promoted free trade and his administration launched the negotiations that led to the North American Free Trade Association and Uruguay Round of global trade liberalization. The net effect, as illustrated by this data from the Confederation of British Industry, was several decades of lower taxes on international commerce. (see Figure 18 below)

One final observation is that the Reagan Administration focused on trade liberalization among friendly nations. The President and his team took a much more jaundiced view on economic relations with the Soviet Union, which may offer some lessons for today’s lawmakers as they deal with a potentially hostile China.

The problem today:

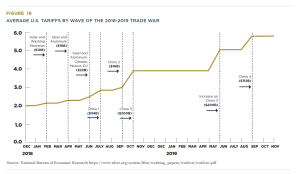

Unfortunately, progress has ground to a halt. Trade barriers have increased in recent years. According to a study for the National Bureau of Economic Research, the federal government tripled taxes on imports in 2018-2019.34

Other nations imposed retaliatory trade taxes on American exports, compounding the damage. (See Figure 19 below)

A major problem for the United States is the use and misuse of so-called Section 301 tariffs. According to the Tax Foundation, these trade taxes (imposed by Trump and mostly maintained by Biden) have destroyed 166,000 jobs, lowered wages, and reduced overall economic output.35

Research from the Federal Reserve found that the tariffs led to reduced employment in the manufacturing sector.36

There are two other challenges for global trade. First, there has been a weakening of the World Trade Organization, which is unfortunate since the United States has won the vast majority of cases it has filed thus opening new markets for American exports.37 Second, largely because of China and India, the process of trade liberalization though the GATT has halted, so it is very unlikely that there will be further “multilateral rounds” to boost the global economy.

Reaganomics 2.0 solutions:

Undoing recent protectionist policies would be an obvious step in the right direction, especially if other nations also agree to reduce or eliminate their destructive trade taxes. Another logical step would be to seek bilateral and plurilateral free trade agreements with select nations. Given the breakdown of the GATT process, this is making a virtue out of necessity. But it also may be the best approach since it would allow the United States to exclude nations such as China that use industrial policy and other types of intervention to distort trade.

Interestingly, even Donald Trump recognized that free trade among allied countries was a good idea, commenting that the United States and European Union should have “zero tariffs, zero non-tariff barriers and zero subsidies on nonauto industrial goods.”

Last but not least, to improve the chances of good trade policy in the long run, supporters of good economic policy also should strive to educate the public about the harm of protectionism. In part, this is a simple story about comparative advantage, specialization, and competition – the same things that make trade between New York and Texas a good thing also make trade between Canada and Texas a good thing.

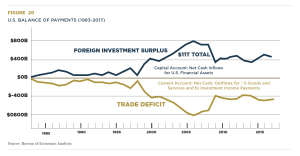

It is also crucial to help people understand that a trade deficit is not necessarily a bad thing. Indeed, it can even be a good thing because a trade deficit automatically means that a nation has a capital surplus. In other words, when foreigners earn dollars by selling goods and services to Americans, they sometimes decide to invest that money in the U.S. economy. That’s a sign of strength, not weakness.

Conclusion

Economic liberty is vital for human flourishing. During the1980s, President Reagan enacted a wide range of promarket reforms that triggered several decades of strong growth. Unfortunately, policy has become more dirigiste in the 21st century, and the economy is now experiencing sub-optimal performance.

Today’s challenges are not identical to the problems that existed in 1980, but there is one big similarity. The economy was experiencing below-par performance when Reagan took office because of too much government. Likewise, the economy today is suffering from anemic performance because of too much government.

The solutions to today’s problems, broadly speaking, are the same as the solutions to the problems Reagan inherited. America needs lower tax rates, spending restraint, less red tape, and monetary prudence. That’s how to boost American greatness.

Endnotes

- https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDMsM10sImRhdGEiOltbImNhdGVnb3JpZXMiLCJTdXJ2ZXkiXSxbIk5JUEFfVGFibGVfTGlzdCIsIjEiXSxbIkZpcnN0X1llYXIiLCIxOTgzIl0sWyJMYXN0X1llYXIiLCIxOTg4Il0sWyJTY2FsZSIsIjAiXSxbIlNlcmllcyIsIkEiXV19

- https://www.jec.senate.gov/public/_cache/files/e4491bc9-9aa0-45c3-943a-a86c1497828c/the-reagan-prosperity—november-1995.pdf#:~:text=The%20Reagan%20expansion%20years%20marked,million%20new%20jobs%20were%20created.

- https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1800-

- https://www.nytimes.com/2022/09/26/opinion/gop-economic-policy.html

- See https://www.theamericanconservative.com/against-zombie-reaganism/, https://www.nationalreview.com/2020/07/the-zombie-reaganism-trap/, and https://www.washingtonpost.com/opinions/2021/10/12/too-many-republicans-misunderstand-reagans-legacy/.

- https://budget.house.gov/press-release/cbo-reports-14-trillion-deficit-in-first-nine-months-of-fy2023-under-bidens-watch

- https://fred.stlouisfed.org/graph/fredgraph.pdf?hires=1&type=application/pdf&bgcolor=%23e1e9f0&chart_type=line&drp=0&fo=open%20sans&graph_bgcolor=%23ffffff&height=450&mode=fred&recession_bars=on&txtcolor=%23444444&ts=12&tts=12&width=1318&nt=0&thu=0&trc=0&show_legend=yes&show_axis_titles=yes&show_tooltip=yes&id=M2SL&scale=left&cosd=2019-01-01&coed=2023-06-01&line_color=%234572a7&link_values=false&line_style=solid&mark_type=none&mw=3&lw=2&ost=-99999&oet=99999&mma=0&fml=a&fq=Monthly&fam=avg&fgst=lin&fgsnd=2020-02-01&line_index=1&transformation=lin&vintage_date=2023-08-21&revision_date=2023-08-21&nd=1959-01-01

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20230726a.htm

- https://taxfoundation.org/blog/biden-budget-taxes/

- https://www.americanactionforum.org/testimony/testimony-on-regulatory-burdens-and-economic-growth/#:~:text=The%20burden%20of%20federal%20regulations,the%20growth%20of%20regulatory%20costs.

- https://oversight.house.gov/wp-content/uploads/2023/06/hoc_testimony_mulligan_20230614-1.pdf

- https://oversight.house.gov/wp-content/uploads/2023/06/Testimony-of-A.-Campau_House-Oversight-Hearing_06.12.2023.pdf

- https://www.cbo.gov/system/files/2021-03/57021-Financing.pdf

- https://www.cbo.gov/system/files/2022-04/57867-Debt.pdf

- https://www.oecd.org/economy/public-finance/The-effect-of-the-size-and-the-mix-of-public-spending-on-growth-and-inequality-working-paper.pdf

- https://danieljmitchell.wordpress.com/2012/02/09/data-in-new-world-bank-report-shows-that-large-public-sectors-reduce-economic-growth/

- https://www.whitehouse.gov/omb/budget/historical-tables/

Fiscal years do not coincide with calendar years. Prior to 1976, fiscal years began on July 1, which meant, for instance, that the 1970 fiscal year began on July 1, 1969. Since 1976, fiscal years have begun on October 1, which meant, for instance, that the 1980 fiscal year began on October 1, 1979. To a large degree, this is merely a technical distinction, but it is worth mentioning because the proposals of a new president generally don’t take effect until the fiscal year that starts after they are inaugurated. In the case of Reagan, that means his first budget was 1982 (starting October 1, 1981) and his last budget was 1989 (ending September 30, 1989). That being said, the charts show data for 1980, 1981, 1988, and 1989 to give readers a wide range of data points. - https://www.cbo.gov/publication/59159

- https://www.cbo.gov/publication/59331

- https://www.bls.gov/data/inflation_calculator.htm

- https://taxfoundation.org/historical-income-tax-rates-brackets/

- https://www.irs.gov/statistics/soi-tax-stats-soi-bulletins

- https://www.realclearmarkets.com/articles/2022/02/08/joe_biden_should_learn_from_jimmy_carters_greatest_economic_triumph_815372.html

- https://cammack.house.gov/media/press-releases/congresswoman-cammack-introduces-reins-act-limit-executive-overreach

- https://www.heritage.org/government-regulation/report/how-roll-back-the-administrative-state

- https://www.bls.gov/cpi/tables/supplemental-files/

- https://www.census.gov/library/publications/2022/demo/p60-276.html

- https://www.washingtonpost.com/opinions/robert-samuelson-volcker-reagan-and-history/2015/01/11/9c32e822-982a-11e4-aabd-d0b93ff613d5_story.html

- https://danieljmitchell.wordpress.com/2023/02/08/the-war-against-case-part-vi-the-case-against-a-central-bank-digital-currency/

- https://www.congress.gov/bill/118th-congress/house-bill/24?s=1&r=7

- https://www.youtube.com/watch?v=9Juzn2lHm4g, https://www.youtube.com/watch?v=Tp1T7kPEdDY, and https://www.youtube.com/watch?v=4VKRsvN55ZA.

- https://en.irefeurope.org/Publications/Online-Articles/article/Activist-Trade-Policies-More-Risks-than-Benefits/

- https://www.nber.org/papers/w26610

- https://taxfoundation.org/research/all/federal/tariffs-trump-trade-war/

- https://www.federalreserve.gov/econres/feds/files/2019086pap.pdf

- https://www.wsj.com/articles/trumps-war-on-the-wto-1530723098